PR

We deliver FOCUS H&S news quickly and accurately.

[Company Visit] FOCUS HNS, a company specializing in one-stop security solutions

September 15, 2022

[Lee Jaemo Lee, CEO of Growth Research] FOCUS H&S is a company specializing in one-stop security solutions. Company Name H&S stands for Humanity and Safety. It is a word that shows the direction of the company's business that emphasizes human safety.

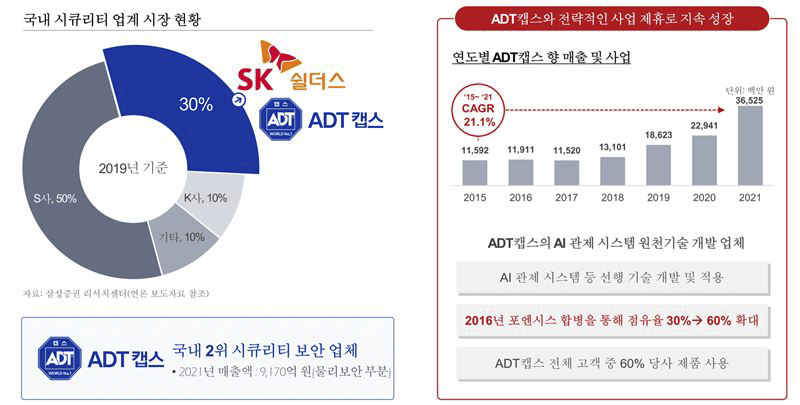

Its main business is developing and supplying physical security systems, manufacturing security cameras and storage devices, and even supplying related solutions. Since 2019, it has been expanding its business area by launching products with artificial intelligence functions added. In 2015, when it developed the world's first AHD DVR, it drew attention for its technology and signed a supply contract with SK Shielders (formerly ADT Caps).

Since then, it has become a key partner of SK Shielders and secured a stable source of revenue. Currently, more than 75% of total sales are supplied to SK Shielders. Recently, it has been supplying all of the image processing devices and cameras related to the original technology related to the AI (artificial intelligence) control system. Unlike competitors who supply products in single units, Focus HNS is increasing its market share within customers by supplying products in package form. By the end of this year, the company expects its market share to increase to up to 80%.

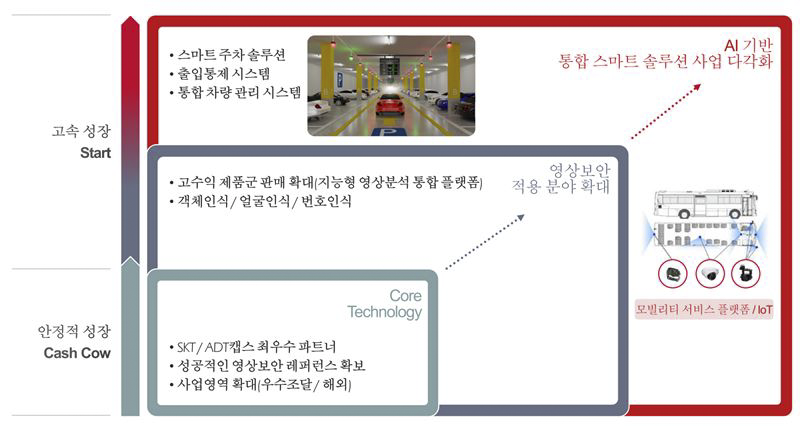

It does not stop at the current business, but is continuously developing technology and expanding its business. Currently, five new projects are underway: ① AI video control ② Smart parking solution ③ Mobility service platform ④ Smart access management ⑤ IoT Box (unmanned store management system). Most of the new businesses are not businesses in the distant future, but are generating tangible results from businesses whose sales are being reflected right away, so earnings growth is expected going forward.

Sales in 2022 are expected to reach KRW 70 billion and operating profit to KRW 6 billion. This year's record high is expected. Sales to SK Shielders, a major customer, are generating stable sales, and the operating margin is improving as video storage devices and cameras with AI functions are delivered. We present a target price of KRW 3,800.

An important thing to check is that the company's two largest shareholders, the two Company K funds, have a stake of more than 15%, which is a risk that an overhang issue may occur during the liquidation of the fund in the future.

The author, Lee Jae-mo, CEO of Growth Research, has visited more than 1,000 companies as an investment asset management company and is appearing on Korea Economy TV.

[Editor's Note] This is the content of the analysis after visiting the company by 'Growth Research', an independent research company. Viewers is not responsible for the investment results related to the article.